Property Tax Assessment

Our Tax Assessment department is dedicated to providing accurate and reliable tax-related services for properties. We ensure that every aspect of the process is handled with precision, from initial surveys to final payment submissions. Our team of experts uses the latest technology and practices to offer a streamlined and transparent assessment process.

Head of Department - Mr. Sachin Bhaskarrao Tupatkar

Our comprehensive services are designed to cover every stage of the tax assessment process, ensuring that all property owners are accurately assessed and fairly taxed. We adhere to the highest standards of quality and accuracy, making sure that our clients receive the best service possible.

Tax Assessment Services

Information Gathering

We gather essential data on properties, including ownership, occupancy, and usage details. This ensures that the valuation process is based on accurate and up-to-date information, allowing for proper assessment and tax calculation.

Property Numbering

We assign unique identification numbers to each property, simplifying tracking and assessment. This systematic approach ensures that each property is accounted for during the valuation process.

Property Measurement

Using advanced tools like laser tape, we accurately measure property dimensions. Precise measurements are critical for calculating property values and ensuring fair tax assessment.

Draw Line Plan

On-site line plans are drawn to outline property boundaries clearly. This step is crucial in defining property limits and avoiding disputes in the future.

Filling Correct Information

We ensure accurate data entry by carefully inputting all gathered information. This accuracy is critical for generating reliable reports and for legal compliance.

Form Filling

All necessary forms related to property taxation are meticulously filled out, ensuring completeness and compliance with regulatory requirements. Proper documentation is key to avoiding penalties.

Entering Property Attributes

We record essential property attributes such as location, area, and structural details. This information is vital for property classification and valuation purposes.

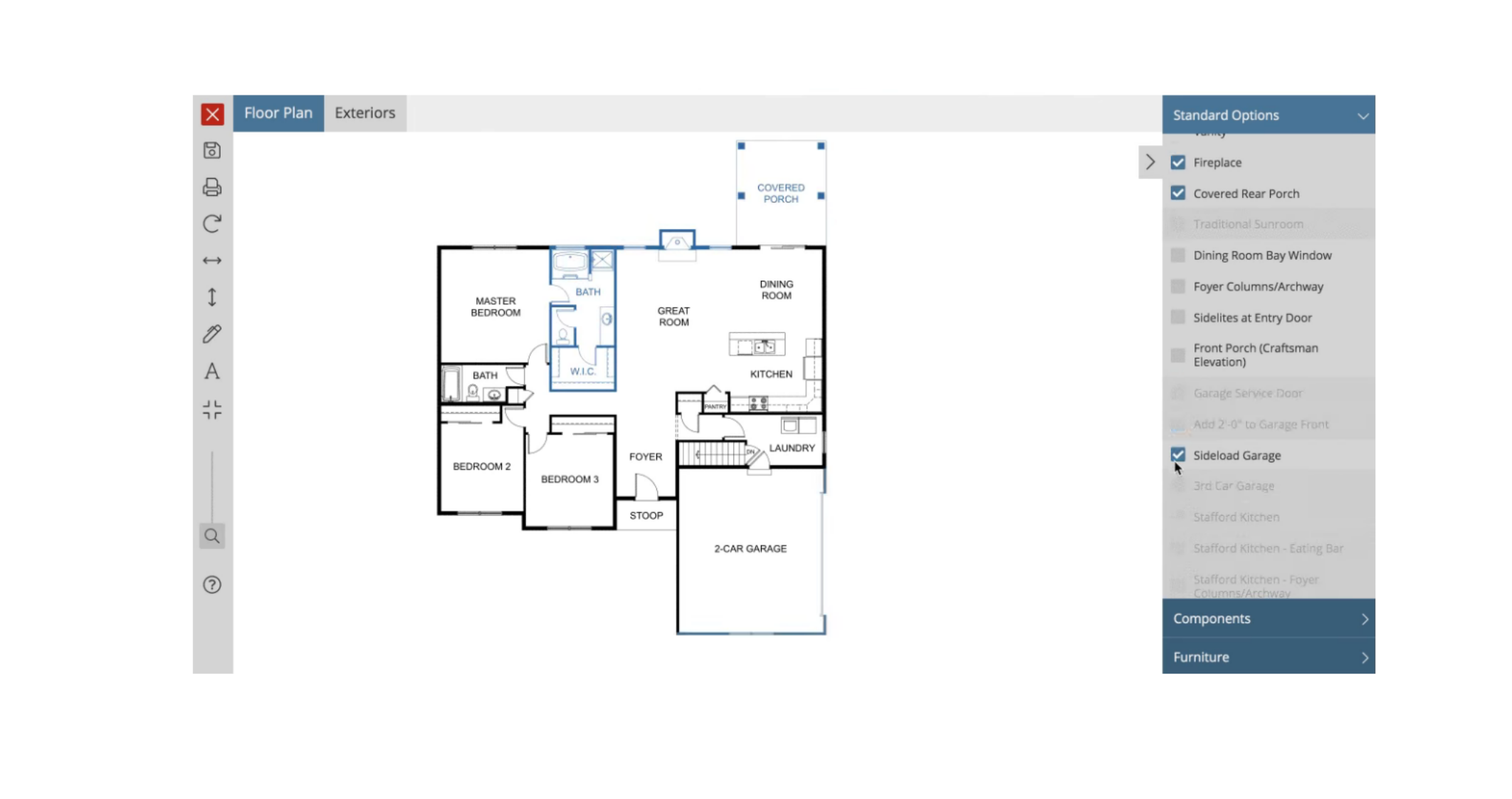

Creating Property Plan

We develop detailed property plans that outline the structure and layout. These plans are crucial for accurate representation and further analysis during tax assessment.

Drawing Digital Plan on Software

We digitize property plans using advanced software, allowing for easy access and updates. Digital plans are essential for accurate data storage and future reference.

Calculating Property Area

We accurately calculate property areas, which are critical for determining property tax values. This ensures that each property is assessed fairly based on its size and use.

Quality Control (QC)

Our QC process ensures that all gathered data is thoroughly verified and validated. This minimizes errors and guarantees the reliability of the final reports.

Cross-checking All Information

All collected data undergoes a cross-checking process to ensure consistency and accuracy. This step is crucial in avoiding discrepancies in the final reports.

Ensuring Data Accuracy

Our team ensures that all data entered is correct and free from errors. Data accuracy is essential to maintaining the integrity of the assessment process.

Finalizing Reports

We compile the validated data into comprehensive reports, which are used for final tax assessments. These reports provide a clear summary of the entire process.

Payment Gateway/Submission

We offer secure payment gateway services for tax submission. This allows property owners to pay taxes online, ensuring convenience and timely payment processing.

Online Tax Paying Service

Our platform enables property owners to pay taxes online, streamlining the payment process. This service is available 24/7, ensuring flexibility for users.

Receipt Generation

Once the payment is made, a digital receipt is generated and emailed to the user. This receipt serves as proof of payment and can be used for future reference.

Tax Amount Maintenance

We ensure that the correct tax amount is maintained and updated in our system. This helps in avoiding any discrepancies during tax submission and future audits.